The Child Tax Credit is here to boost families!

We have great news! Thanks to the American Rescue Plan (ARP) signed by President Biden in March, the Child Tax Credit has now been expanded to reach more families--even if you've made little to no income in the past year. This means more money for more families to raise their kids! How much money? Starting around July 15th, the expanded Child Tax Credit will provide $300/month for each child under the age of 6 and $250/month for each child age 6-17. That's a whole lot of money! We know you have questions (including if you don't normally file taxes). But don't worry, we're here to provide trusted answers.

Frequently Asked Questions About the Child Tax Credit

- How do I access the Child Tax Credit if I don’t normally file my taxes?

- What is the Child Tax Credit?

- Do I have to do anything to get the Child Tax Credit?

- What is new about the expanded Child Tax Credit? How much money will I get?

- Who is eligible for the newly expanded Child Tax Credit?

- What is the income limit to get the expanded Child Tax Credit?

- How do the monthly payments work?

- If I get the monthly payments will I owe anything when I file my taxes next year?

- I filed my 2020 taxes but I have had a baby or adopted a child in 2021. Can I still get the expanded Child Tax Credit monthly payments?

- What does “qualifying child” mean? Who is a “qualifying child” for the expanded Child Tax Credit?

- Do I or my children need a social security number to get the Child Tax Credit?

- What do I do if I am divorced and we both have custody of our child? (And we normally alternate years claiming our child?)

- What can I do if my child’s other parent gets the CTC when it is not their year to claim our child?

- Can my advance payments be reduced if I owe child support payments, back taxes, or Federal or state debt?

- Will the Child Tax Credit count against government benefits like SNAP/food stamps, Medicaid, child care subsidy, etc?

- Are the changes to the Child Tax Credit permanent?

- I received a letter indicating I might be eligible - is there anything I need to do?

- Where can I get help filing my taxes?

- Is there info on the newly expanded Child Tax Credit in other languages besides English?

- This is being paid in 2021, but which tax year does it refer to?

- Where will my Child Tax Credit payment be sent?

- What if I’m an undocumented immigrant but my children are American citizens--can we still get the Child Tax Credit?

- Will I lose out if I don’t sign up to receive the Child Tax Credit by July 15th?

- What if I don’t want to get the monthly payments? Is there a way to opt out?

- Will I have to pay any of the monthly payments back to the IRS?

1. How do I access the Child Tax Credit if I don’t normally file my taxes?

Great news--the Child Tax Credit is now available to people who earned little or no income in the past two years and may not normally file taxes! If you did not have to file taxes this year (your tax return for 2020) or last year (your tax return for 2019), and you did not sign up for Economic Impact Payments (commonly called “stimulus checks” or “stimmies”) last year, you can still sign up for the Child Tax Credit payments. The good news is that through the IRS Non-filer Sign-up Tool you can also apply for any Economic Impact Payments (“stimulus checks”) that you’re entitled to but may not have received yet.

Here’s a list of things you will need to complete the process.

- Social Security numbers for your children and Social Security Numbers (or an ITIN) for you and your spouse

- A reliable mailing address

- Date of birth

- E-mail address

- Your bank account information (if you want to receive your payment by direct deposit).

We know you might be nervous about providing a social security number or bank information but we promise you this is safe as long as you submit it directly to the IRS. The bank account information is optional and only if you want to receive direct deposit. The social security numbers (or ITIN numbers) is mandatory though so they can verify that you are who you say you are and make sure they are getting you the correct amount of money.

2. What is the Child Tax Credit?

Enacted in 1997 and expanded with bipartisan support since 2001, the Child Tax Credit (CTC) helps families offset the cost of raising children. With the new improvements passed this year in the American Rescue Plan, the Child Tax Credit is now available to most families, even if you make little to no income, for 2021.

3. Do I have to do anything to get the Child Tax Credit?

Most families won’t have to do anything at all to receive the Child Tax Credit payments. If you filed taxes this year (your tax return for 2020), filed last year (your tax return for 2019), or if you signed up for Economic Impact Payments (commonly called “stimulus checks” or “stimmies”) using the IRS’s Non-Filer tool last year, you’re all set and the IRS will automatically send you monthly payments---you will either get it directly deposited into your bank account if the IRS has that information or you will get a check mailed to you.

If you did not have to file your taxes this year or last year, and you did not sign up for Economic Impact Payments last year, you can still sign up for the Child Tax Credit payments. The good news is that through the IRS Non-filer Sign-up Tool you can also get any Economic Impact Payments (“stimulus checks”) that you’re entitled to but may not have received yet.

4. What is new about the expanded Child Tax Credit? How much money will I get?

Thanks to the American Rescue Plan (ARP), signed by President Biden in March 2021, the Child Tax Credit has a number of great improvements which translate to more money for families raising kids! For tax year 2021, the ARP increases the amount of the Child Tax Credit (CTC) from a maximum of $2,000 per child under age 17 to a maximum of $3,600 per child under age six, and $3,000 per child ages six to 17. The ARP also makes the CTC fully refundable, even for families with no earned income. This means that even if you didn’t make any income this year you can still get the Child Tax Credit.

The ARP also allows families to receive advance payments of up to half of their CTC amount in 2021. Starting on July 15th these payments will be sent monthly, meaning families will receive a monthly check of at least $300/child ages 0-5 or $250/child 6-17. The monthly payments will occur every month on or around the 5th of the month, through December. You must file a 2021 tax return in 2022 to get the remainder of the Child Tax Credit as a lump sum.

5. Who is eligible for the newly expanded Child Tax Credit?

Nearly all families with children ages 17 and under qualify for the newly expanded Child Tax Credit, even people who made little to no income in the past two years. Some income limitations apply. For example, only married couples (who file joint returns) making less than $150,000 and single parents (who file their taxes as Head of Household) making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with higher incomes may receive the standard Child Tax Credit amount, depending on their incomes. See question below for more information about income limits.

6. What is the income limit to get the expanded Child Tax Credit?

Most families will get the full, expanded amount of the Child Tax Credit this year: $3,600/ child under age 6 (or at least $300/month) and $3,000 /child ages 6 to 17 (or at least $250/month).

The following families qualify for the expanded Child Tax Credit of up to $3,600 per child ages 0-5 and $3,000 per child ages 6-17:

- Married couples (filing joint returns) with incomes under $150,000;

- Families with a single parent (filing as Head of Household) with incomes under $112,500; and

- Everyone else with incomes under $75,000.

The following families will qualify for the standard Child Tax Credit amount of up to $2,000 per child under 17 (which comes out to up to $167 per child each month):

- Married couples (filing joint returns) with incomes under $400,000;

- Families with a single parent (filing as Head of Household) with incomes under $200,000; and

- Everyone else with incomes under $200,000.

Families with even higher incomes may receive smaller CTC amounts, or no credit at all.

7. How do the monthly payments work?

People who gave their bank information to the IRS will receive payments by direct deposit. They will get their first payment on or around July 15, 2021. After that, payments will go out on the 15th of every month. (In August the payment will go out on August 13th since the 15th falls on a weekend.) If you haven’t provided the IRS with your bank account information for direct deposit on a recent tax return, a check will be sent out to you, around the 15th of the month starting in July, to the address the IRS has for you. If your address or banking information has changed, you will be able to update it through the CTC Update Portal later in the summer.

You will get monthly payments through the end of the year (December 15th) and then the remainder of your Child Tax Credit will be paid to you after you file your 2021 taxes in 2022 (we are waiting on more guidance, but even if you normally don’t file taxes, in order to receive the remainder of the CTC, you’ll still need to file a tax return in 2022).

If you don’t want to receive advance monthly CTC payments, you can opt out by going here.

8. If I get the monthly payments will I owe anything when I file my taxes next year?

Whether you will owe taxes when you file a 2021 tax return in 2022 will depend on a number of factors including your income (if any), taxes withheld (if any), and other tax credits you may be eligible for. If you earn less than $40,000 as a single filer, $50,000 as head of household, or $60,000 for married couples filing jointly, you won't have to repay any of the money, even if there was an overpayment. There are some instances where you might want to opt out of the monthly payments and just get the lump sum when you file your taxes in 2022. This article is helpful in determining that.

9. I filed my 2020 taxes but I have had a baby or adopted a child in 2021. Can I still get the expanded Child Tax Credit monthly payments?

First of all, congratulations! And yes! The IRS CTC Update Portal (CTC UP) will eventually allow you to update information about your dependents and then you can start getting the advance CTC payments for them. (We are hearing this could happen as early as mid-August but keep checking the Update Portal to see if you can add that info in). Even if your child is born or adopted after July 15th, you can still get the advance Child Tax Credit in 2021.

10. What does “qualifying child” mean? Who is a “qualifying child” for the expanded Child Tax Credit?

“Qualifying child” is just a fancy IRS way of saying that you have a kid who meets the requirements for certain tax benefits. This child must also fulfill the following criteria:

- The child is the taxpayer’s son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, a grandchild, niece, or nephew).

- The child is a U.S. citizen, U.S. national, or U.S. resident alien.

- The child lives with the taxpayer for more than one-half of tax year 2021.

Time lived together does not have to be continuous. (There are some exceptions to this including temporary absence by your or your child for school, vacation, business, medical care, military service, or detention in a juvenile facility. The IRS also has some exceptions for children of divorced or separated parents and children who have been kidnapped).

- The child does not provide more than one-half of his or her own support during 2021.

- The child does not file a joint return with the individual’s spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid.

Also, for the newly expanded CTC, a qualifying child must not turn 18 before January 1, 2022.

11. Do I or my children need a social security number to get the Child Tax Credit?

Your child needs a valid Social Security number and you will need a Social Security Number or ITIN (Individual Tax Identification Number).

12. What do I do if I am divorced and we both have custody of our child? (And we normally alternate years claiming our child?)

The IRS will base the 2021 advanced Child Tax Credit payments on the most recently filed tax return (either 2019 or 2020). Therefore, any advanced payments are scheduled to automatically go to the most recent parent to claim the child. That parent should have received an IRS letter in early June notifying them of this. The IRS CTC Update Portal enables the taxpayer to opt out of the advanced payment. If they do, they will not have to pay the amounts back when they file their 2021 tax return and do not claim the child for the CTC if it is the other parent’s turn to do so. However, there is a potential safe harbor so that lower-income taxpayers may not have to pay back erroneous the advanced CTC (the safe harbor begins to phase-out at $40,000 for single, $50,000 for head of household and $60,000 for married filing jointly families). This may delay issuing the remaining half of the CTC amount to the other parent, as IRS sorts it out.

Taxpayers who have difficulty using the IRS CTC Update Portal may also call a designated toll free number for assistance in opting out of the payments : 1-800-906-4184.

It is unclear at this time whether the parent who agrees to opt out of the advance payments could also redirect the payments to the other parent, or whether that parent can only claim the full CTC on the next tax return.This is an area that is likely to be updated by the IRS and we will make sure to provide more info on this page as it becomes available.

13. What can I do if my child’s other parent gets the CTC when it is not their year to claim our child?

See above for what the other parent can do to stop receiving the payments. It is better for them to do that as soon as possible. If they don’t agree to do that, when you file your 2021 tax return properly claiming the child you may also be eligible to receive the full amount of the CTC. If the other parent, who has received the advanced CTC payments again claims the CTC, the IRS will have to determine which parent was eligible. This usually is done by the IRS determining which parent lived the longest with the child in the previous year. This examination will likely significantly delay any refunds to either parent. If the other parent who got the advance payments is found not to have been eligible, whether they claim the CTC or not they may have to pay the advanced amount back either through a reduced total tax refund and/or additional amount due. There is a potential safe harbor so that lower-income taxpayers may not have to pay back erroneous advanced CTC payments (the safe harbor begins to phase-out at $40,000 for single, $50,000 for head of household and $60,000 for married filing jointly families). This will not reduce the amount of the CTC you can receive as a refund, if you are found to be the eligible parent.

14. Can my advance payments be reduced if I owe child support payments, back taxes, or Federal or state debt?

No. Depending upon your state, however, non-federal debtors may be able to garnish advance Child Tax Credit Payments.

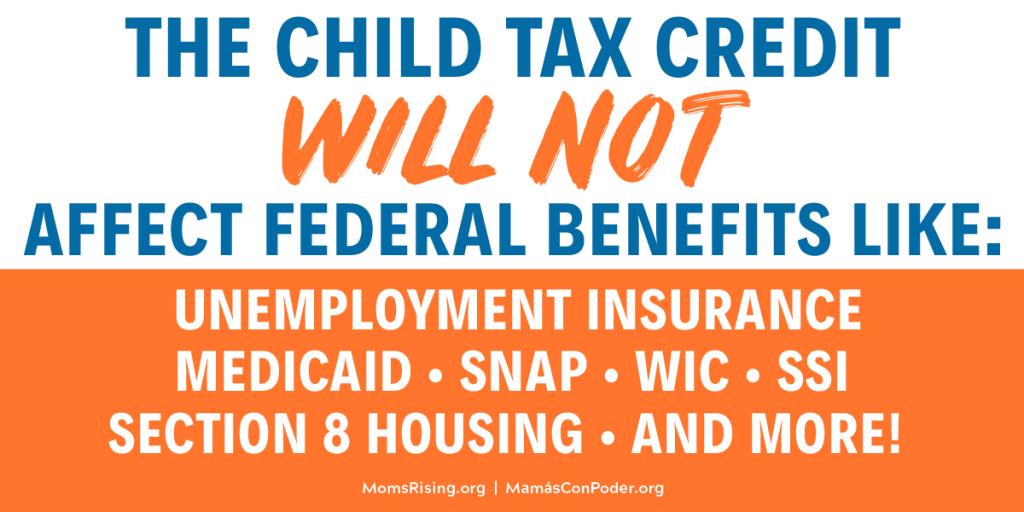

15. Will the Child Tax Credit count against government benefits like SNAP/food stamps, Medicaid, child care subsidy, etc?

No. Receiving Child Tax Credit payments will not change your eligibility for, or the amount you receive from, other Federal benefits like unemployment insurance, Medicaid, child care subsidies, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not consider refunds from tax credits as income.

16. Are the changes to the Child Tax Credit permanent?

No. Under the American Rescue Plan, the CTC amount is expanded, advance monthly payments are available, and the credit is fully refundable for only one year (2021). But there is a big push right now to make sure the amazing changes to the CTC are made permanent in the next recovery and infrastructure package. We need your help in speaking out though! Sign our letter calling on Congress to make the changes to the CTC permanent.

17. I received a letter indicating I might be eligible - is there anything I need to do?

This letter went to people who filed tax returns in 2019 and 2020. If you got a letter, you likely do not need to do anything at this time but you can check to make sure all your information is correct on the IRS’ Child Tax Credit Update Portal.

18. Where can I get help filing my taxes?

The IRS will be holding free tax prep clinics in select cities in August and September to help people file for the new Child Tax Credit. These are safe places to get help and get your questions answered. Just make sure to check out the website first so you know what materials to bring with you.

In addition, our partners at United Way have offices across the country where they can help you with tax prep and answer questions you might have about the Child Tax Credit. You can access their 211 line to ask questions or set up an in-person appointment (where available). You can also find your closest United Way office here.

If you are looking for additional help, here are some resources:

-Step-by-step guide for using the non-filer portal.

-Video on how to use the non-filer portal.

-Trusted free tax filing services online: GetYourRefund.org and MyFreeTaxes.com

-Guide on how to use the IRS Child Tax Credit Update Portal.

19. Is there info on the newly expanded Child Tax Credit in other languages besides English?

Yes! MomsRising has created this entire website in Spanish on our Mamas Con Poder website. In addition, the non-filer portal is now available in 8 different languages, as well as the Child Tax Credit Update Portal.

20. This is being paid in 2021, but which tax year does it refer to?

The Child Tax Credit payments are for the 2021 tax year.

21. Where will my Child Tax Credit payment be sent?

The IRS will send your payments by direct deposit to the bank account they have on file. If they don’t have bank account information for you, payments will be mailed to you to the address you provided (either from your tax returns this year or if you are filing for the first time, the address/info you give them in the non-filer portal). Starting in August, you will be able to use the Child Tax Credit Update Portal to update the IRS with yur bank account info so you can get direct deposit.

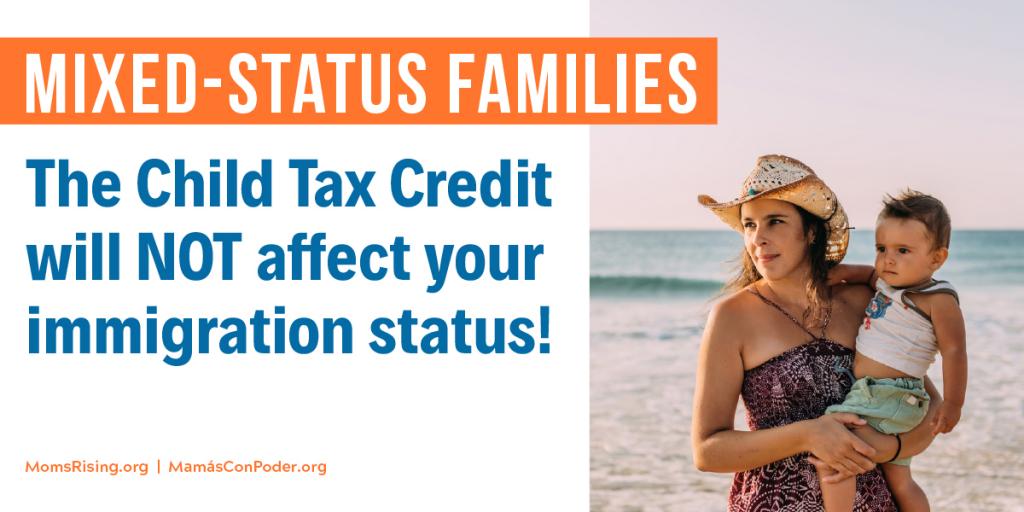

22. What if I’m an undocumented immigrant but my children are American citizens--can we still get the Child Tax Credit?

Yes you can still get the Child Tax Credit! If you have not filed taxes for the past three years or signed up to receive a stimulus check, you should use the non-filer portal, even if you make little to no income and don’t usually file taxes. In order to do this, you will need a valid ITIN (Individual Tax Identification Number). If you don’t currently have one or need to renew yours,you can learn more here. Once you get your ITIN,you can sign up for the Child Tax Credit advance payments (see question #20).

You can also find more information here.

23. Will I lose out if I don’t sign up to receive the Child Tax Credit by July 15th?

No. Remember that many families don’t need to do anything to receive the advance CTC payments. For those who do: Everyone who signs up and is eligible will receive the full amount of the advance Child Tax Credit payments for which they qualify. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive your full CTC amount when you file your taxes in 2022.

24. What if I don’t want to get the monthly payments? Is there a way to opt out?

Yes. If you don’t want to get the monthly payments and just want to get it in a lump sum when you file your 2021 taxes (in 2022) you can go to this IRS website.

25. Will I have to pay any of the monthly payments back to the IRS?

No. The monthly payments are not a loan, they are an advance payment on the full amount of the child tax credit you would normally get after you file your taxes next year. There are only a few circumstances where people may need to pay this money back after they file their taxes in 2022. See question 8 for more information.