Head Smacker: U.S. Corporate Taxes are Below Average, but Some Continue to Call for Lowering Them Even Further

We’ve repeatedly heard the calls from “pro-business” members of Congress and supporters: the U.S. corporate tax rate is too high. It drives businesses overseas, they say. We need to lower the corporate tax rate to bring and keep business here, allow U.S. companies to compete internationally, create jobs and grow the economy, they say. But when we look at the facts, we see why these claims are such head smackers.

First, these calls usually cite the U.S. statutory corporate tax rate – which is 35 percent – as evidence that businesses are getting the shaft. But in fact, the U.S. is well below other competitor developed nations in corporate taxation, and Fortune 500 companies paid an average federal effective tax rate of 19.4 percent.

House Speaker Paul Ryan’s (R-WI) website, for example, states that, “Currently, the U.S. corporate tax rate is 39.1 percent – the highest in the industrialized free world” (the 39.1 percent takes into account both federal and state statutory rates). Speaker Ryan has repeated called for cutting corporate tax rates, and proposed cutting the statutory rate to 25 percent, calling low rates the “secret sauce” of economic growth.

Similarly, in an opinion piece for Fox News, House Ways and Means Committee Chair Kevin Brady (R-TX) said, “Our sky-high 35 percent corporate tax rate bears much of the blame” for corporate inversions and foreign mergers like the planned Pfizer-Allergan merger. Speaking at a Politico event in January, Chairman Brady said he thinks the corporate tax rate needs to be “under 20 percent” and that any tax revenue received from companies bringing profits back to the US should be used to lower rates.

The U.S. Chamber of Commerce also jumped on the recent proposed Treasury Department rule that caused the collapse of the Pfizer deal, saying in a statement, “Punishing the business community, as the Obama administration has proposed, is not the answer. The real solution is comprehensive tax reform that lowers rates for all businesses and shifts to a competitive international system that both allows American companies to compete globally and attracts foreign investment to the United States.” Even the Obama Administration itself has proposed cutting the statutory rate.

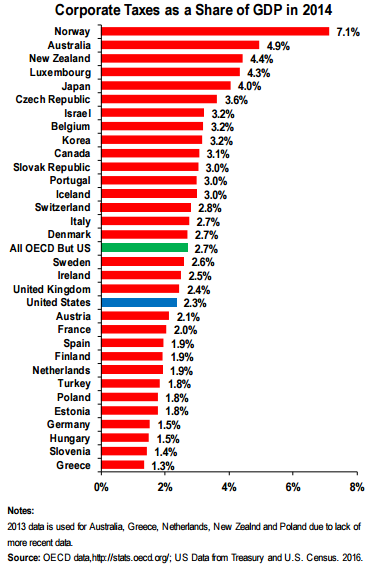

But with a myriad of loopholes, tax breaks and other exceptions they’ve managed to get into the tax code, most corporations don’t pay anywhere near that 35 percent rate and instead pay a much, much lower “effective” tax rate. A report out last week from our friends at Citizens for Tax Justice (CTJ) shows that corporate income taxes in the U.S. are significantly less than the average among developed nations. In fact, the U.S. ranks 20th out of 32 developed nations when looking at corporate taxes as a percentage of GDP. This report also cites earlier findings from CTJ that Fortune 500 companies paid an average federal effective tax rate of 19.4 percent, just over half that often-cited 35 percent rate.

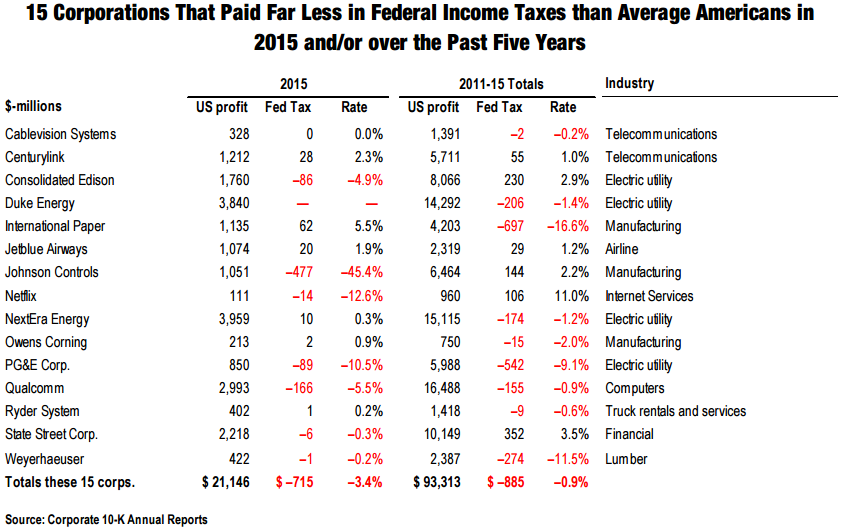

Another report out just this week from CTJ showed how successful many big corporations are in paying no tax at all, dodging billions of dollars in taxes and, in many cases, even getting a refund from the government despite making billions in profits. The report highlighted 15 Fortune 500 companies that, as a group, paid no federal income tax on $21 billion in profits in 2015 and no tax on $93 billion in profits over the past five years. Not only did they not pay any tax, but seven of the companies received federal tax rebates in 2015. This is real money being lost that could support human needs programs. The highest rate that any of them paid last year was 5.5 percent – a far cry from the 35 percent rate that’s too often thrown around as a reason we need to lower our corporate tax rate.

We also know that research out last year from the Center for Effective Government found that corporate tax cuts don’t equate to new jobs, and that that tax cuts for lower- and middle-income folks are more effective than tax cuts for the wealthy or corporations at spurring economic growth.

Despite all of this, we expect we’ll continue to hear certain members of Congress and presidential candidates go on and on about how the U.S. needs to cut corporate tax rates. And later this year or next, we may even see legislative proposals to do so. But every time we hear those claims, we’ll be smacking our heads, because we know the facts.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!