Care.com Finds that a Majority of Americans Want Subsidized Child Care

I remember the day I realized I couldn’t afford the day care center I wanted.

They had baby yoga and a curriculum I coveted. But the annual cost would have crippled our family. “The annual cost is more than your take home pay,” my husband said looking at the center’s application. The more affordable center had a waitlist of over a year, and ultimately, we had to create a patchwork plan of family and a part-time nanny until we could get off the list.

And though I never received infant art projects, it was ultimately a great experience, full of loving people.

That was 8 years ago. And my husband and I had no idea that child care would start consuming SO much of our household income.

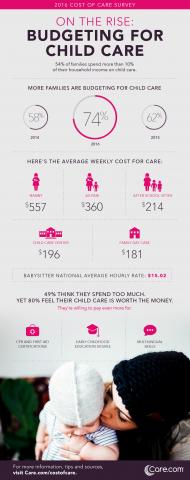

Today, we have three children, a nanny, pre-school, camp and afterschool expenses. We join the 54% of families who told Care.com that they spend more than 10% of their household income on child care as well as the 3/5 families who ask themselves “WHERE IS ALL THE MONEY GOING?”. This data is from Care.com’s third annual Cost of Care survey, which found that in order to pay for care, families have:

· Saved less money (50%)

· Completely stopped saving money (32%)

· Saved less for retirement (29%)

· Stopped paying off debt (27%)

· Asked someone for money (24%)

The Cost of Care Survey by Care.com also found that:

· 21% of families say they spend $30,000 or more for each child

· 74% of families are now budgeting for care

· 92% of those budgeting, start saving when they’re pregnant

· 29% of families say they’d even pay their caregivers more per week if they are tech-savvy and can teach their children about technology

· 21% of respondents say they’ve waited to have children specifically because of child care costs

· 63% of families are unaware they could use an FSA to help pay for child care expenses

· 1 in 4 have put themselves in debt -- or further debt -- to pay for child care

· 80% of the families surveyed feel their child care plan is worth the money

How does this affect the workplace?

· 67% state that child care costs have influenced their career decisions

· 43% of parents feel they have to work harder to make more money to cover child care

· 85% wish that their employers would offer child care benefit

· 74% believe their jobs have been impacted because their child care plans have fallen through

One reality is that many families feel forced to have one parent stay home because they cannot afford child care – or they feel the cost isn’t worth the sacrifice of missing time with their child(ren). And after three months of bonding with this incredible newborn, it’s a whole lot easier to opt out when you feel your take-home pay is peanuts.

The Center for American Progress analyzed this reality new parents face and created a calculator to show the annual lost income – beyond direct salary, when one person leaves the workplace. You can run that calculation here. It’s truly shocking.

I’ve learned a lot of things in the eight incredible years I’ve been a parent. One of them is how much I truly love my career – and I’m so glad there was an affordable option in which we could place our child, so I could continue to work, dig into my passion a little more, and increase my salary along with my skills. Another thing I’ve learned is that child care is temporary restraint. In a few years, all my children will be in public school, and I’ll feel like I just won the lottery.

But we need more affordable options. The fact that I had to wait 9 months to get off a waitlist so we could afford child care is ridiculous. This country puts so much emphasis on college being affordable, but we’ve only recently started talking about affordable child care. The Care.com survey found that half of the families surveyed said they wish the U.S would subsidize child care. 16% said they wish they could move to a country that subsidizes child care.

But what CAN you do? Today’s presidential nominees are talking about their plans to reduce child care costs. You can learn where the candidates stand on child care and VOTE this November.

Learn the three other ways you can budget and save for child care

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!