Join us for the #TaxChat Tweetchat on March 17th!!

Tax Day is just around the corner (Wednesday, April 15th to be exact). Are you prepared to file your taxes? Have any questions? Want to learn more about how your tax dollars are used and why some billionaires and wealthy corporations pay less in taxes than you?

We’ve got you covered!

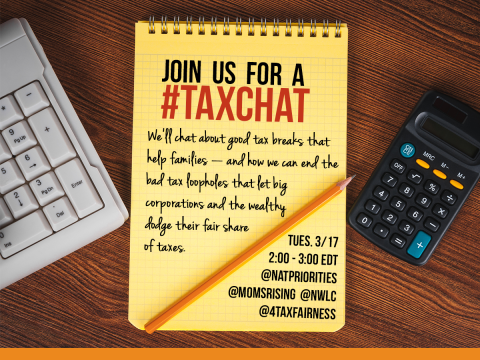

Join MomsRising and our partners at Americans for Tax Fairness, National Priorities Project, and National Women’s Law Center on Tuesday, March 17th at 2pm ET/12pm PT for a #TaxChat tweetchat. In the lead up to Tax Day we'll discuss ways families can prepare to file their taxes, tax breaks that benefit working families (like EITC, CTC, and the child care tax credit), how our tax dollars are used and negative tax policies that are harming families in the name of big business. Join us with your questions and ideas by using the hashtag #TaxChat.

You can help promote the tweet chat by sending out the following tweets to your followers:

- Join @MomsRising @4TaxFairness @natpriorites @nwlc on 3/17 2pm ET to discuss ways tax breaks can help put more $ in your pocket. #TaxChat

- Getting ready 2 file your taxes? Join @MomsRising @4TaxFairness @natpriorities @nwlc on 3/17 2pmET for the #TaxChat.

- There are good taxes and bad taxes. Learn more during #TaxChat on 3/17 at 2pm ET with @MomsRising @4TaxFairness @natpriorities & @nwlc.

- Find out how filing your taxes can mean more $ for your family.Join @MomsRising @4TaxFairness @nwlc @natpriorities 3/17 at 2pm for #TaxChat

- Want to learn more about how taxes can help or harm your family and community? Join the #TaxChat at 2pm ET 3/17.

- Our tax system is pitting families vs. big business.Learn more on 3/17 at during #TaxChat w/ @MomsRising @4TaxFairness @NWLC @natpriorities

Be sure to follow @MomsRising, @4TaxFairness @natpriorities and @NWLC and the hashtag #TaxChat to participate.

We want to provide you and your family with useful information on how to file your taxes. But we also want to encourage Congress to strengthen and protect the EITC and Child Tax Credit, so make sure to write your members of Congress today (and share the link on social media): http://action.momsrising.org/sign/EITCChildTaxCredit/

Do you have experience with the EITC or Child Tax Credit? Do tell! How has the EITC and Child Tax Credit helped your family? Have these tax credits helped you keep your head above water? What would you be able to do with this extra money? Please share your thoughts and experiences here: https://www.momsrising.org/member_stories/topic/has-the-earned-income-tax-credit-eitc-or-child-tax-credit-ctc-helped-your-family/

I hope to see you on Twitter on Tuesday, March 17th at 2pm ET/12pm PT!!

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!