Later this month the Supreme Court will announce its decision in King v. Burwell, a case that threatens the health coverage of millions. This overview will bring busy readers up to speed on what’s at stake in the case and what the fallout will be if the justices rule against the government (the case specifically names U.S. Department of Health and Human Services Secretary Burwell).

What’s King v. Burwell about?

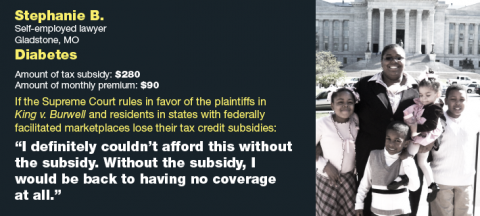

The case challenges the federal government's provision of tax credits (also known as "subsidies") to help low- and middle-income people afford their health insurance premiums in states that didn't set up their own health insurance marketplace (exchange). The plaintiffs claim that Congress never meant to extend premium tax credits to consumers in states that didn’t establish their own marketplaces directly but use marketplaces set up by the federal government (federally facilitated marketplaces).

How could King v. Burwell affect people’s health insurance coverage?

This case will affect the cost of health coverage for those who rely on premium tax credits, but will also have ramifications throughout the private health insurance market.

Premium tax credits create a stronger and more robust health insurance market by increasing and diversifying the pool of enrollees so that healthy people, in addition to sicker people, are included. In doing so, they help keep down health insurance premiums for everyone.

By ending the credits, a ruling in favor of the plaintiffs would throw the health insurance system into chaos. A recent report by the American Academy of Actuaries only reinforces this concern, noting that the concentration of people with “high-cost health needs” who would remain in the insurance market as healthier people exit would cause average health costs, and therefore premiums, to rise. A study by the Urban Institute estimated thatpremiums would spike by an estimated 35 percent in 2016. This is one reason why doctors, insurers, and hospitals all weighed in to support the government's position.

Who supports the government in King v. Burwell?

Groups representing a diverse set of stakeholders – from people with serious health conditions to hospitals – filed legal briefs supporting the view that Congress always intended to bring affordable health insurance to people in every state through the provision of premium tax credits.

Included among supportive stakeholders are members of Congress who wrote the ACA and the governments of 22 states plus the District of Columbia. (See Families USA’s amicus brief.)

Why must the court rule in favor of Burwell (the U.S. government)?

The court is expected to announce its verdict in King v. Burwell during the last 10 days of the month. To prevent serious ramifications and devastation for consumers, hospitals, providers, and insurers, the court must rule in favor of the government. This is the verdict that upholds the law. When considering the Affordable Care Act in its entirety, as well as the fact that states were never told that access to subsidies depends on creating a state-based marketplace, it is clear that premium tax credits were always meant to be available to consumers in every state.

****Originally posted on the FamiliesUSA website: http://familiesusa.org/blog/2015/06/what-you-need-know-about-king-v-burwell

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!