GM Gets Tax Break, Lays Off Workers

GM Layoffs Prove Tax Cuts Hurt, Don’t Help, Workers

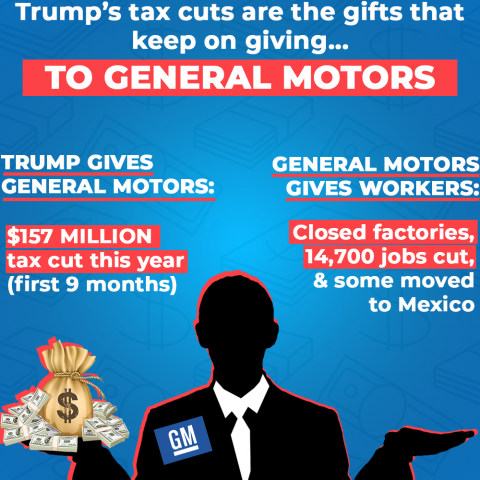

General Motors’ announcement yesterday that it was idling five North American assembly plants and laying off nearly 15,000 workers proves once again that the only guaranteed winners from corporate tax cuts are corporations and their wealthy shareholders—not local communities and working families.

So far this year, the giant automaker reports that it has received a tax cut of $157 million (Exhibit 99.2, (e)) courtesy of the Trump-GOP tax overhaul enacted in late 2017. Because the new law cut the corporate tax rate by 40%, those kind of savings will continue for GM year after year. On top of those yearly savings, the Republican law handed GM a one-time tax break likely totaling hundreds of millions of dollars more on the $6.5 billion in accumulated profits (p. 31) the company has stashed offshore.

But instead of investing those savings in American communities and workers, the company has so far this year spent $100 million of its tax-cut windfall buying back its own shares (p. 24), a Wall Street maneuver that almost exclusively enriches the already wealthy. It also has undoubtedly continued to shower its top executives with massive pay packages: last year, CEO Mary Barra pulled down almost $22 million in total compensation, 295 times the pay of an average GM employee.

And just six months after the Republican tax cut that was supposed to spur domestic investment, the company announced it would build its Chevrolet Blazer in Mexico rather than the United States.

While GM uses its U.S. tax savings to reward Wall Street investors—the company’s stock rose 4% on the layoff news—top executives and foreign communities, thousands of loyal GM autoworkers and their families in Maryland, Michigan and Ohio can only look forward this holiday season to pink slips and empty factories.

President Trump and his Republican allies in Congress promised the huge tax cuts they showered on wealthy households and profitable corporations would trickle down to average Americans. Trump went too far as to promise every working family a $4,000 raise.

But so far only 4% of American workers have received any kind of raise or bonus tied to the corporate tax cut. And corporations have spent 117 times more on wealthy shareholders through share buybacks than they’ve given workers in increased pay: the lopsided score is $830 billion to $7 billion.

The simple truth is corporate tax cuts don’t help workers, they hurt them. Those cuts reduce revenues, creating bigger deficits that President Trump and his fellow Republicans use as an excuse to cut public services working families rely on like Social Security, Medicare and Medicaid.

GM’s massive job cuts following huge corporate tax cuts are just the latest example of the failure of tired old trickle-down economics. What GM workers and all working Americans need is a brand new economic policy that ensures the wealthy and corporations pay their fair share of taxes while our communities and working families get the public services and investments they need and deserve.

The views and opinions expressed in this post are those of the author(s) and do not necessarily reflect those of MomsRising.org.

MomsRising.org strongly encourages our readers to post comments in response to blog posts. We value diversity of opinions and perspectives. Our goals for this space are to be educational, thought-provoking, and respectful. So we actively moderate comments and we reserve the right to edit or remove comments that undermine these goals. Thanks!