Blog Post List

November 28, 2018

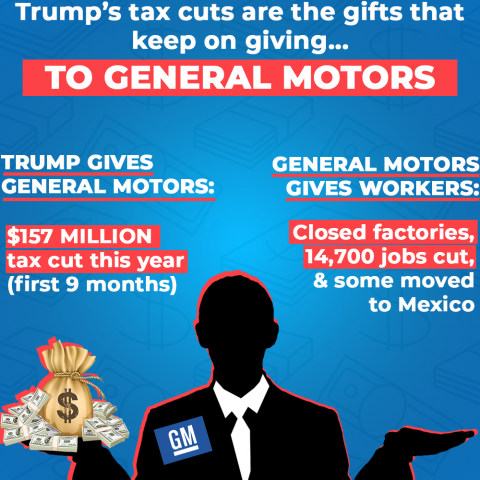

General Motors’ announcement yesterday that it was idling five North American assembly plants and laying off nearly 15,000 workers proves once again that the only guaranteed winners from corporate tax cuts are corporations and their wealthy shareholders—not local communities and working families. So far this year, the giant automaker reports that it has received a tax cut of $157 million (Exhibit 99.2, (e)) courtesy of the Trump-GOP tax overhaul enacted in late 2017. Because the new law cut the corporate tax rate by 40%, those kind of savings will continue for GM year after year. On top of...

MomsRising

Together

October 21, 2015

Budgets are made up of equal parts spending out and revenue in. But budget negotiators in Washington this fall are talking only about what spending to cut, not what revenue to raise—even though there are tax loopholes to close that should draw rare bipartisan support and eliminate the need to cut programs that benefit tens of millions of Americans. The White House and Congressional leaders are trying to work out a budget deal before a temporary spending measure runs out December 11. Progressives are trying to avoid $37 billion worth of across-the-board cuts to services slated to kick in...

MomsRising

Together

April 2, 2014

General Electric got $3 billion in U.S. income tax refunds between 2008 and 2012. You read that right: They paid LESS THAN ZERO in taxes. You probably paid more than they did! We have a chance right now to close two of the biggest tax loopholes that let them do it -- but we have to act really fast. Tell Sen. Ron Wyden to close GE's loopholes and make them pay their fair share of taxes. These two loopholes reward big corporations like GE for shifting profits to offshore tax havens, where the U.S. can't tax them. Sen. Wyden (D-OR) chairs the powerful Senate Finance Committee, which will vote...

MomsRising

Together